Robinhood Recap

- Dec 21, 2017

- 3 min read

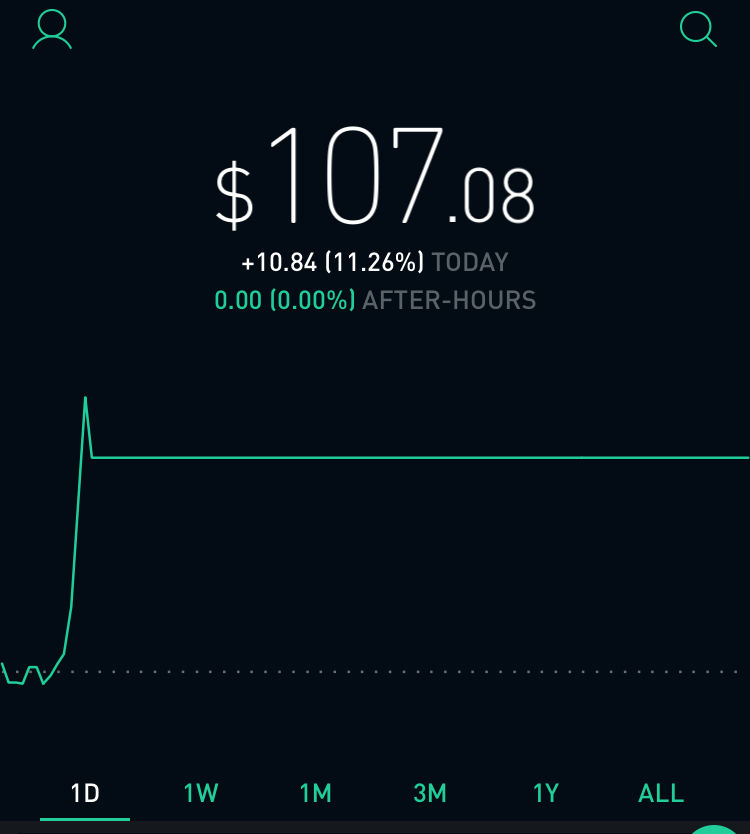

What a great start! The first week trading on our Robinhood account we've already seen a 7% Profit, putting our account value just above $107. Let's recap exactly how we did it.

One of the best parts about day trading, and trading stocks in general, is that you only need to be right a portion of the time. This week, I was only right 1 out of 3 times. How did I profit you ask? By managing risk. The first and third trade were failures, therefore, they will be the greatest focus of this blog post.

Yesterday, I started the week by trading $NETE. It's quite simple what went down. The stock was showing upward momentum, and I bought in right before it reached a major resistance line (a price level that is hard to break). The right move would have been to buy in IF it broke the resistance line (which it didn't). Not much later it suffered a pullback putting me in the red, and when it tried to climb back up to where I bought in at, it showed downward momentum. I sold out with a 5% risk level putting me down $5 to start off. This is a classic example of FOMO or fear of missing out. I may be the writer of a stock trading blog, but I'm definitely going to commit stock trading sins once in a while. To add fuel to the fire, a coupe hours later the price jumped up randomly. However, I can't sit back and think, "Landen you idiot! If only you would have held!" I refuse to do so because there was no way to predict the jump in price, and managing risk is more profitable than hope. The photo below displays my crappy NETE trade.

Finally, we hit our weekly gold mine. $NXTD was a classic halt play. When the price of a stock is moving too fast, and too many trades are happening, the New York Stock Exchange will halt the stock (usually for 5 minutes). No trades can happen during the halt. They do this to see if there is still an excess of interest after a 5 minute time out. If you are experienced and quick, you can buy in before the halt. You want to do this, because the NYSE will place the new price higher than it was whenever it was halted. In my case, I first bought in at $5.08. The stock was halted after climbing a little, and then re-opened near $5.50. It continued to climb rapidly towards $6. I immediately sold to secure my profits when the volume (how many trades are happening) decreased near the $6 mark. This gave me a great 14% profit on the day. I then tried to do another trade, however, I made many mistakes.

I re-entered the trade when it finally broke the new $6 resistance, but it soon failed to stay above. I lost 3% on this trade, because I was actively managing my risk. There are two issues with this trade. First of all, I should have waited for a more ideal time to buy in, possibly near a support line. Secondly, I should have used a larger risk tolerance, because not much later the price continued to climb upwards. I would much rather risk 3% than go balls to the wall and lose it all, but sometimes you need to risk more than usual. However, I would have never needed to risk so much if I would have bought at the right time. See the photo below to understand the nonsense above.

Over the next couple weeks, we will develop more strategies to make Humble Money, and further improve our account.

Comments