Two Days Down, and a Couple Grand up

- Jan 9, 2018

- 3 min read

I want to start this article by discussing why I share my success. The last thing I want, and need, is for people to think I am bragging about what I do. I am writing this article so that everyone can learn my process, and how I achieved what I did, so that they too can grow. Now let's get to the goods.

Many people hate Mondays, but let me be the first to say that Monday (Jan 8) was an amazing day. A couple trades were made, and so was a good amount of money. Let's discuss these trades, and why they went so good.

I say we start with the best trade out of the bunch. NSPR gave me some pretty good feelings when this penny stock made a whopping 150%+ move!!! On Monday, the company was having a normal, boring day when it announced good news. This stock had a decent spike in price going from 13 cents to 16 cents (it may only be .03, but that's a 20% move!). Once it settled down, I jumped in for another spike. My average price was around $.156, and it wasn't until later in the day that the price went crazy. The stock was moving until the market closed, and then continued climbing higher during after-hours trading. Understand the stock market is only "open" from 9:30 - 4:00, but you can trade many hours before and after market hours. In the last 6 hours of the trading day the price went from a low of 15 cent all the way up to 34! I decided to hold the shares through the night, in order to sell today for a better price. The next day didn't go nearly as perfect as I would have hoped. Once the market opened, the price jumped up as I knew it would, but didn't stay up like I hope it would have. It was clear to me that the price didn't have much higher to go, so I sold my shares at $.26. Of course I can't complain, as increased my investment by over 60%! I made a couple grand off this trade, and surpassed my weekly goal. What a great start!!!

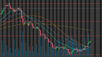

Now, lets talk about a great swing trade I've started, and one I am still holding. JDST is an inverse Gold ETF, which means as gold goes down in price, JDST goes up. Gold has been climbing very high lately, and may start reversing down. JDST has also hit a major support (a price level where the stock may start heading back up). I bought into this ETF at $50, and my target price is $65. I took a position of 300 shares giving me a profit margin of $4500. That would suffice for 3 weeks according to my weekly goal, and would make Landen very happy. The price has already climbed to $55, and is showing great strength. I'm very proud of this trade, as I was able to predict the price to start heading up, and executed the trade at the perfect time. Let's keep our fingers crossed that I reach my target price. The picture below shows the chart for JDST, and gives you some idea of how much room there is to work with. Notice the red lines in the chart. These are support and resistance lines. The second to top, red line (just above the yellow dashed line) is my target price.

I also made a couple day trades today (Tue. Jan 9). I'm not going to go into detail with these trades, but I want to share what companies I traded, so you can go and see the action for yourselves. For all of these trades, I made around $100 - $400. The tickers for these companies include PTIE, MYSZ, and DSLV.

Comments